Tax Payment & Scenarios in Alma

| Reviewed and Revised by Acquisitions | |

|---|---|

| Revision Date |

First, some tips:

![]() View/Read these before you attempt to pay taxes in Alma:

View/Read these before you attempt to pay taxes in Alma:

- MF-03 Invoicing and Tax (36 min video)

- VAT Calculation - Examples (part of the "Creating Invoices" Alma doc)

- Acquisitions 03 (28 min video)

![]() Don't be confused by Alma's use of the term "VAT." The VAT functionality in Alma is how you pay all tax - which is usually sales and use tax for most of us.

Don't be confused by Alma's use of the term "VAT." The VAT functionality in Alma is how you pay all tax - which is usually sales and use tax for most of us.

![]() When adding tax to an invoice, you enter either the tax % or the amount; the system will calculate the other field.

When adding tax to an invoice, you enter either the tax % or the amount; the system will calculate the other field.

![]() All non tax-exempt vendors need to have enabled in their vendor record.

All non tax-exempt vendors need to have enabled in their vendor record.

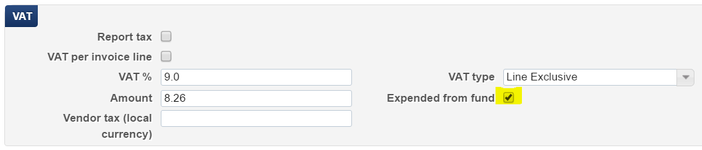

![]() Understand VAT Types and the Expended from Fund options:

Understand VAT Types and the Expended from Fund options:

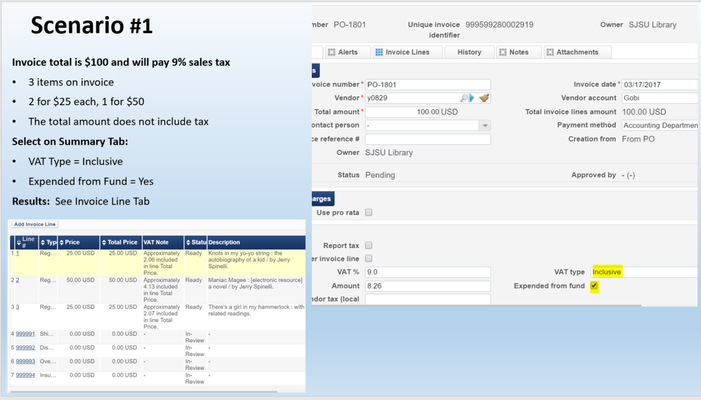

- Inclusive: The invoice total amount includes VAT.

- Exclusive: VAT is added above the invoice total amount.

- Line Exclusive: The invoice's total amount includes VAT (similar to Inclusive), but the VAT amount is calculated outside of the invoice lines' total value and is not factored into the individual invoice lines.

- Expended From Fund:

- Choose this option if the tax amount is to be expended from the invoice line’s fund.

- Clear it to indicate that the tax amount is to be expended from a separate fund or as a separate line item (adjustment invoice line).

![]() Understand Governmental Vendors (how you'll pay "Use Tax"):

Understand Governmental Vendors (how you'll pay "Use Tax"):

- The Governmental Vendor – Create this vendor to receive use tax payments for an invoice payment from non-governmental vendors. Only one per institution permitted, so for the CSU, it's the State of California.

- If a governmental vendor is associated with the institution, and the vendor is defined as liable for VAT (liable for use tax), and an invoice is set to report (use) tax, then, when the invoice is created, a separate invoice for use tax is automatically generated for the use tax. (see Amazon example below)

- A governmental vendor's invoices handle only use tax on invoices, ensuring that tax payments are handled separately from the regular invoice charges and go directly to the government (so, the State of California.)

- A governmental vendor is used only for handling use tax invoices - not to pay for materials or resources.

Scenarios

(Page in development - more scenarios coming soon)

More information from the Ex Libris Knowledge Center Alma FAQ:

How does Alma handle payment of taxes, VAT?

Alma treats various taxes as an additional charge on the invoice. Taxes can be distributed between one or more line items on an invoice, or lumped together as a single charge in the “header” of an invoice. Libraries have an option of pro-rating taxes as part of the invoice line items and charging them to various funds, or to charge the taxes to a special “tax” fund if necessary. Alma will allow the library to pay taxes at different tax rates based on where an invoice for an item is paid.

The following table presents how Alma handles VAT payments based on three key configurations:

Whether the (non governmental) vendor has an associated governmental vendor

Whether the vendor is noted as Liable for VAT

Whether the VAT is reported for the invoice (either by selecting Report VAT or by manually entering the VAT amount)

For other charges than VAT (Shipment, Insurance, Overhead, Discount) the user has two option:

If you select Use pro rata, the above amounts are not displayed individually on the invoice, and their values are distributed among the invoice lines.

If you do not select Use pro rata, each additional charge is displayed as an individual invoice line.

What additional charges can be added to the invoice?

Alma supports the following options as part of the invoice record:

- Shipment amount

- Insurance amount

- Overhead amount

- Discount amount